![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

6 Cards in this Set

- Front

- Back

|

Explain monopolistic advantage theory. |

Monopolistic advantage theory This theory suggests that firms that use FDI as aninternationalisation strategy tend to control certainresources and capabilities that give them a degree ofmonopoly power relative to foreign competitors. The advantages (specific to the MNE) that arise from thismonopoly power enable the MNE to operate foreignsubsidiaries more profitably than the local firms thatcompete in those markets. The most important monopolistic advantage is superiorknowledge, which includes intangible skills possessed bythe MNE that provide a competitive advantage over localrivals in foreign markets. |

|

|

Explain Internalisation theory |

Internalisation theory The internalisation theory explains the process of firms by acquiring and retaining one or more value-chainactivities inside the firm, minimising the disadvantages of dealing with externalpartners and allowing for greater control over foreign operations andits proprietary knowledge. The cost–benefit analysis is analysed for FDI versusexporting, licensing or other arms-length entry modes. By internalising foreign-based value-chain activities, it isthe firm, rather than its products, that crosses internationalborders. |

|

|

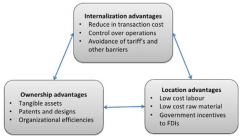

Explain Dunning's eclectic paradigm |

Dunning's eclectic paradigm MNE activity can be viewed in terms of the combination ofthe competitive advantages of firms and the comparativeadvantages of countries (using the pre-Porterterminology). Dunning builds on previous works, including thecomparative advantage, factor endowments, monopolisticadvantage and internalisation approaches. |

|

|

What are the roles of comparative andcompetitive advantages in the success of PumpkinPatch? |

Comparative advantage has been defined as thosesuperior features of a country that provide the country andits companies with unique benefits in global competition. Pumpkin Patch’s comparative advantage is derived from Costs in one country being buffered by the price that thecompany is able to charge in another market. The costs are influenced by two significant factors in the UKmarket (according to the case) firstly, a decline in the value of the New Zealand dollar ascompared to the UK pound at the time, and secondly, the global financial crisis (GFC) affectingspending more generally. These resulted in increased costs of overheads for physicalretail locations and wages relative to expenditure combiningwith changes in customer behaviour whereby online sales areeroding physical store sales. The quality price threshold for the apparel is also likely in thecontext of the GFC to lead to product substitution. Competitive advantage comprises those distinctive assetsor competencies of the company typically derived fromcost, size or innovation strengths that are difficult forothers to compete against. Pumpkin Patch’s competitive advantage includes An historical capacity to innovate, to enter new markets, The perceived quality and associated brand reputation alongwith a capacity to perform in the world of internet shopping. The online marketspace is not new to Pumpkin Patch. In sum, Pumpkin Patch likely has competitive advantage in theform of experience and skills, because (according to thecase) The proximity to market for design and manufacture is notlikely a weak link as this has always been a facet of businessactively managed by Pumpkin Patch for many years. They are demonstrating strategic thinking in response tomanaging their market entry via Amazon in France,Germany and the United Kingdom, which likely offsets costsassociated with advertising and achieving market reach. |

|

|

What are the ownership-specific advantages,location-specific advantages and internalizationadvantages for Pumpkin Patch? |

O: It has been suggested that starting as a new business inNew Zealand contributed to their success. The aim was alwaysto grow and it was seen that this would naturally includeoffshore markets significantly different to New Zealand. L: The ‘home’ market is tough and demanding and serving thismarket forced the organisation to confront and be mindful ofonline technologies as they evolved their global brandrecognition and innovative quality design. I: Being at such a distance from other markets has in alllikelihood forced the company to be mindful of relationshipsassociated with all aspects of supply and distribution, as wellas product alignment for the various retail markets. |

|

|

Pumpkin Patch might be considered a bornglobal. Does this change the internationalisationprocess? |

It changes the internationalisation process as traditionallydefined. Being ‘born global’ means ‘starting as a youngentrepreneurial organisation that initiates internationalbusiness activity very early in its evolution moving rapidlyinto foreign markets’. Pumpkin Patch engaged in international business activity very earlyon, both by way of retail market presence and in regard tomanufacturing and logistics. This twinned with the characteristics of the fashion industry haslikely had a significant impact on its decision making, strategic mindset and goals, and this in turn informs the organisation’s depth ofexperience and connections in its everyday activities. |