![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

35 Cards in this Set

- Front

- Back

|

How much Social Security benefits do you lose if you continue to work? |

In 2015, a person under the full retirement age loses $1 in Social Security benefits for every $2 earned above the allowable limit of $15,720 until the first day of the year the worker reaches full retirement age. In that final year, the person loses only $1 in Social Security benefits for every$3 earned above the allowable limit of $41,880.

|

|

|

With a core-satellite asset allocation strategy, the percentage of a portfolio in the core portion portfolio should be?

|

The core portion in a core-satellite asset allocation strategy should be 60% to 80% of the portfolio. (LO 2-4)

|

|

|

As described in the text, what are the four key questions that clients generally ask in making the retirement decision?

|

a. Can I afford it?

b. Is this the right time? c. How will my spouse/family be affected? d.Do I want to retire? |

|

|

What is a correct statement about an age-weighted profit sharing plan?

|

An age-weighted profitsharing plan is similar to other profit sharing plans in that contributions (orminimal contributions) do not have to be made each year. An age-weighted profitsharing plan is a type of qualified plan that allocates employer contributionsbased on compensation and age. Age-weighted profit sharing plans use actuarialassumptions to allocate employer contributions. This is in contrast toconventional profit sharing plans, which allocate employer contributions basedon compensation alone. Younger non-key employees may complain about anage-weighted profit sharing plan because older non-key employees receive largerallocations of employer profit sharing contributions even though their earningsare nearly identical. Hence, participants with the same compensation may notreceive equal allocations of plan contributions under an age-weighted profitsharing plan.

|

|

|

When can a company establish a SEP? |

An employer need not establish a SEP by year-end. Instead, an employer may set up the SEP and make contributions, including the initial contribution, as late as the due date of the employer's income tax return, including approved extensions. (LO 5-7)

|

|

|

When does someone become eligible for Medicare Part A? |

Individuals must be totally and permanently disabled (satisfy Social Security's definition of disability) and have received Social Security disability benefits for 24 months to be eligible for Medicare Part A. (LO 6-4)

|

|

|

Every year, Fidelity publishes a study on anticipated medical expenses in retirement. According to the most recent study, what is the expected amount of UN-reimbursed medical expenses for a couple, age 65, who live to be around 85 years old?

|

According to a study by Fidelity, a couple reaching age 65 who live to a normal life expectancy (around age 85) can expect to have medical expenses in retirement of around $220,000.

(LO 7-2) |

|

|

William Bengen presented one of the earliest studies on safe initial withdrawal rate percentages. What percentage did Bengen originally suggest?

|

Early work in this area by William Bengen put a safe initial withdrawal rate at a little more than 4% for an individual in the 60–65 age bracket. In his studies, Bengen found that at around a 4% initial withdrawal rate, with annual adjustments for inflation, just about all well-constructed portfolios would be able to last throughout retirement (at least for 30 years). (LO 8-6)

|

|

|

A "rising equity glidepath" typically will lead to a(n) equity exposure over one'slifetime.

-increased -consistent -decreased |

The strategy of increasing equity exposure throughout retirement can result in less equity exposure over one's lifetime due to the reduced exposure in the early years. (LO 8-6)

|

|

|

Which one of the following is correct regarding taxation of mutual funds?

|

An exchange of share in one fund to share of another fund within the same family is a taxable event. This is commonly referred to as a "telephone transfer." A nontaxable distribution based on interest from a private-activity, not public purpose, municipal bond may create an AMT issue. FIFO will generally create the largest gain during a bull market, because the oldest, lowest cost basis shares are the ones treated as being first sold. FIFO is the method assumed by the IRS if the taxpayer fails to select another method. LIFO is not an allowable method for basis calculations. (LO 10-4)

|

|

|

Annette, a single taxpayer, has lived in her principal residence in Seattle for 18 months, and is relocating to another part of the country due to health reasons. Because she received her home as a gift from her aunt, she will have a gain of $400,000 on the sale. Which of the following is correct with respect to the sale of her home?

|

She will qualify for an exclusion of $187,500 ($250,000 maximum exclusion times 18/24) on the sale of the home. The general rule is that a single person may exclude up to $250,000 in the sale of the home, provided the home has been used as the principal residence for two of the previous five years. A partial exclusion is available if the two-year rule is not met due to health, job, or other unforeseen circumstances. The exclusion is the percentage of the two-year period that the principal residence test is met, times the full exclusion amount. (LO 10-6)

|

|

|

Which one of the following cannot achieve the estate planning goal of providing for incapacity?

durable power of attorney trust disability insurance will |

A durable power of attorney and a trust can be used to manage the financial affairs of an incompetent person. Disability insurance can be used to replace income when an incapacitated person is no longer able to work. Because a will is only effective at death, it cannot be used for incapacity planning. (LO 11-1)

|

|

|

Describe the conceptof substantially equal periodic payments and explainhow this method mightbenefit certain early retirees.

|

The phrase substantially equal periodic payments refers toa methodfor taking qualified plan distributions over theparticipant’s remaininglifetime, as determined by IRS tables. This is generallythe mostpalatable approach to avoiding the 10% penalty on prematureplandistributions.

|

|

|

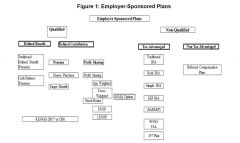

Study the Diagram |

|

|

At what age must anindividual begin taking distributions from an IRA?

|

A required minimum distribution must be made from an IRAfor theyear in which the IRA owner turns age 70½. This firstdistribution maybe delayed until April 1 of the calendar year following thecalendaryear in which the IRA owner turns age 70½. Many advisersmerely tellclients that they must begin taking IRA distributions bythe April 1deadline. This is true, but keep in mind that if the firstrequiredminimum distribution (RMD) is delayed until the year afterthe year anindividual attains age 70½, a second required distributionmust betaken before December 31 of the same year.

|

|

|

What is meant by theterm window plan? |

A window plan describes a set of incentivesused to reduce corporateheadcount through voluntary early retirement. |

|

|

Definehow a deductible works. |

A deductible is the amount that the insuredmust pay before the planpays anything. Deductibles do not apply toevery service, for example,preventive care and wellness benefits such asmammograms andwell-baby care are paid 100% by the insurancecompany. Healthinsurance deductibles are annual deductibles,not a per incidentdeductible. |

|

|

How is coinsurancedifferent from a copayment? |

Coinsurance is a percentage of the expenses that is paid bytheinsurance company once the deductible has been met forcoveredservices. A copayment is a set amount that the insured willpay for aservice such as a doctor visit. The copay amount may or maynot beapplied to the annual deductible or coinsurance percentage,depending onthe plan. |

|

|

What is a healthsavings account? |

A health savings account (HSA) is a tax-exempt trust orcustodialaccount established by an individual or employer with aU.S. financialinstitution (such as a bank or insurance company) for thepurpose ofpaying qualified medical expenses of the account owner(participant),his or herspouse, or dependents. |

|

|

What is theelimination period (waiting period), and what is its purpose in adisability incomepolicy? |

The elimination (waiting) period is the period of timeafter the disabilityoccurs and before benefit payments begin. It acts like adeductible,forcing the insured to bear part of the loss. The longerthe eliminationperiod, thelower the premiums, and vice versa.. |

|

|

What isthe probation period, and what is its purpose in a disability incomepolicy?

|

The probation period is the period of time thepolicy must be in forcebefore it covers the insured for specifiedperils. This protects theinsurance company from having to coverpreexisting conditions if anindividual wishes to purchase a policy whileill or recovering from anillness.Return

|

|

|

What are theeligibility requirements for receiving Medicare benefits?

|

Medicare benefits are available to U.S citizens who are 65years oldand older, disabled (according to the Social SecurityAdministration’sstringentdefinition), or victims of permanent kidney failure.

|

|

|

Explain Medicare Part A |

Part A of Medicare provides insurance forinpatient hospital care,post hospital skilled nursing care and homehealth care, hospicecare for the terminally ill, psychiatrichospital care, and blood.Most of these benefits are limited. Forexample, inpatient hospitalcare will pay for up to 90 days ofhospitalization per benefit period,with a 60-day lifetime reserve. |

|

|

Explain Medicare Part B |

Part B of Medicare provides supplementalmedical insurance tohelp Medicare enrollees pay for physicianservices and otherservices not covered under Part A. For example,after the patientpays the first $147 of physician charges andoutpatient hospitalcare, Part B will pay for 80% of subsequentcharges. It also pays100%of home health care costs.

|

|

|

Who receives benefitsunder Parts A and B?

|

The benefits of Part A are provided to most Medicareenrollees; thereare some exceptions when the Medicare beneficiary must payapremium for Part A. However, Part B benefits are onlyavailable topeople who payregular monthly premiums.

|

|

|

For Medicarepurposes, what is a benefit period and why is it important?

|

The term benefit period is very important in Part A Medicarecoverage. A benefit period begins when the patient firstenters ahospital or covered facility and ends when that patient hasbeen out ofthat facility or another for 60 consecutive days. Thisperiod isimportant because each one involves a patient deductible.Forexample, if a patient is admitted to a hospital, goes home,but has arelapse 61 days after release, readmission to the hospitalwill initiate anew benefitperiod—and a new deductible for the patient.

|

|

|

What ismeant by the term Medigap?

|

The term Medigapdescribesthe costs not covered by either Part A orPart B of Medicare. These costs includedeductibles, the cost ofhospital stays that exceed the number of dayscovered by Part A,coinsurance payments, any costs that exceedMedicare-approvedcharges, the cost of most nonhospitalprescription drugs, and the costof nursing homes.

|

|

|

What isthe aim of Medigap insurance, and how is it categorized to helpconsumerscompare policies?

|

Medigap insurance aims to fill many of the gapsbetween the costs ofhealth care and the coverage provided by PartsA and B. To helpconsumers make sense of a variety of competinginsurance plans—which cover some charges and not others—thesepolicies fall into 14standardized packages labeled A through N.

|

|

|

What isMedicaid, and who is eligible for its benefits?

|

Medicaid is a joint federal and state programthat picks up thedeductible and copayments ordinarily paid byMedicare enrollees.Eligibilityin Medicaid is limited to certain individuals with low incomes.

|

|

|

Describe MedicareAdvantage Plans.

|

The Balanced Budget Act of 1997 created Medicare Part C, orMedicare Advantage, which includes plans offered by HealthMaintenance Organizations (HMOs), Preferred ProviderOrganizations (PPOs), and Provider Sponsored Organizations(PSOs).

|

|

|

Who is eligible tohave a Medicare Advantage Plan?

|

To be eligible for a Medicare Advantage Plan, an individualmust haveMedicare Part A and Part B, cannot have End-Stage RenalDisease(ESRD), and must live in a county or geographic area whereaMedicareAdvantage Plan is available. |

|

|

Describethe advantages and disadvantages of using a Medicare Advantageplan.

|

Advantages include the following:§ benefits not covered bytraditional fee-for-service Medicare—e.g.,drugs and eyeglasses;§ predictable out-of-pocketcosts (with managed care plans);§ there is no need for theMedicare beneficiary to have a Medigappolicy; and§ greater emphasis onpreventive care.There are disadvantages, which include thefollowing:§ Benefits may be limited, ordenied, if network providers are notused.§ When outside the servicearea, benefits may be limited tomedically necessary and emergency care.§ HMOs can terminate programs |

|

|

What are thekey policy features to consider in selecting an LTC policy?

|

The key policy features to consider inselecting an LTC policy aresimilar to those that must be considered indisability income policies.These features are:§ the elimination (or waiting)period before which benefits are paid;§ the maximum benefit period(e.g., five years);§ the daily benefit (e.g.,$100 per day); and§ inflation protection.The LTC policy, however, has a uniqueprovision: “providers of care.”Some policies will pay benefits only if theperson enters a nursinghome; others stipulate that they will providebenefits for home careonly;still others will pay for either. |

|

|

What is the role ofMedicare in long-term care? |

Medicare does not provide much coverage for long-term care.At themost, it will cover some of the cost of staying in askilled nursingfacility or at-home care that follows the release from acoveredhospital stay. Even in these cases, the number of coverednursinghome days andhours-per-day of at-home care are limited. |

|

|

What areADLs, and what is their implication for receiving LTC benefits? |

ADLs are activities of daily living:§ dressing,§ bathing, toileting,§ continence,§ transferring (the ability tomove in and out of a bed, chair, orwheelchair), and§ eating.In a qualified LTCI policy, the inability toperform any two of theseADLstriggers the LTC benefit. |